Ask the Rational Investor: Don’t fear missing out on the markets!

Sunday, April 7, 2024

Over the last three months many stock market indices increased in value by close to 10% continuing strong market returns that investor’s experienced in 2023.

Ask the Rational Investor: Dell: A quiet AI turnaround

Friday, March 1, 2024

In the 1990’s, I remember going to the Gateway computer store in Belden Village. It had a unique feeling similar to Starbucks or an Apple store.

HEALTHCARE: A Year in Review and Outlook for 2024

Thursday, February 8, 2024

By: Robert Szeles, CFA

The year 2023 was a year of few certainties.

The year 2023 was a year of few certainties.

Increasing Liquidity with a Pledge Asset Line

Thursday, February 8, 2024

A Pledged Asset Line (PAL) is a strategic financial tool that allows investors to optimize liquidity while retaining the assets within their investment portfolios.

Ask the Rational Investor: Netflix is now a quality stock!

Thursday, February 1, 2024

The telecom industry has been undergoing ‘cord cutting’ a dramatic change to the industry that has accelerated the last several years due to faster internet speeds (impacting downloading and uploading), increased adoption of smart devices connected to the internet (e.

Fourth Quarter 2023 Market Recap: Soft Landing Triggers Stock Rally

Tuesday, January 16, 2024

Once again, we witnessed a rapid and significant change in the consensus economic outlook which led to a big increase in stock prices.

Investment Outlook: Quality Investing: A Long-Term Outperformer in a Post-Covid Economy

Tuesday, January 2, 2024

In the increasingly stable post-pandemic economy, the significance of quality investing is gaining recognition. This investment strategy, which prioritizes firms with robust financial health, consistent earnings, and positive cash flows, has demonstrated its capacity for long-term superior performance.

Investment Outlook: Commercial Aerospace: There is light at the end of the tunnel

Tuesday, January 2, 2024

Based on the data, commercial aerospace should be a great business and investment opportunity. It’s a duopoly with Boeing and Airbus being the only two major producers of commercial aircraft.

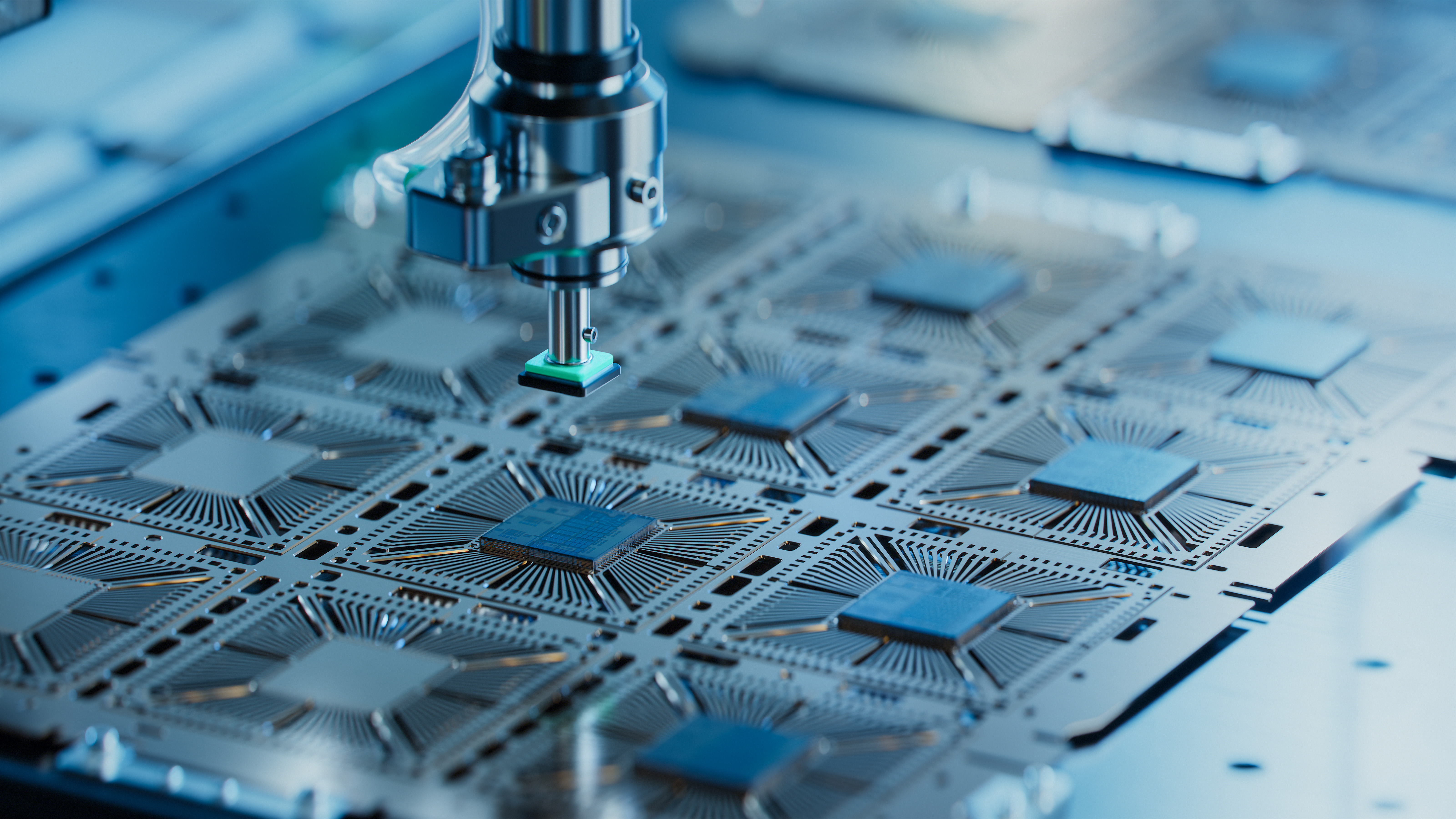

Ask the Rational Investor: Cusp of Manufacturing Renaissance

Tuesday, January 2, 2024

Over the next 7-10 years a dramatic increase in industrial spending is being forecasted as a result of several major infrastructure acts being passed: CHIPS and Science Act, Infrastructure and Jobs Act (IIJA), and Inflation Reduction Act (IRA).

Ask the Rational Investor: Banks are Back!

Monday, December 4, 2023

The last two years have been challenging for bank stock investors as they have dramatically underperformed the S&P Financial Sector (-7%) and S&P 500 (-0. 2%) compared to many of the largest banks, declining 30-50% over the same period.

Beese Fulmer Investment Management, Inc. Partners with Alta Trust to Launch Beese Fulmer Collective Investment Trust and Beese Fulmer Quality Equity Fund

Thursday, November 16, 2023

CANTON, Ohio, Nov. 16, 2023 -- Beese Fulmer Investment Management, Inc.

Beese Fulmer Investment Management, Inc. Achieves GIPS Compliance

Wednesday, October 11, 2023

Canton, Ohio, October 10, 2023 - Beese Fulmer Investment Management, Inc.

Third Quarter 2023 Market Recap and Looking Forward

Sunday, October 1, 2023

When the consensus opinion on the economic outlook changes, the financial markets respond.

Is inflation really subsiding?

Sunday, October 1, 2023

Until the last two weeks or so the stock market resembled the bull market after the pandemic. Led by growth stocks such as Tesla, Nvidia, Microsoft and others on the excitement surrounding generative artificial intelligence.

Rational Investing in an AI Bonanza

Sunday, October 1, 2023

Excitement about Artificial Intelligence has been a major driver of the S&P 500’s performance this year.

Stagflation 101: What It Means for Your Portfolio and How to Position for It!

Sunday, October 1, 2023

Stagflation is a rare but serious economic phenomenon that can pose significant risks for wealthy investors.