Investment Outlook: First-Quarter 2019 - The Year of Tech IPOs

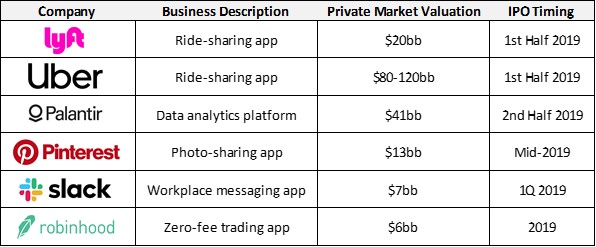

The first quarter of 2019 ended with the highly anticipated initial public offering (IPO) of Lyft. Lyft is a ride sharing company that is smaller but similar to Uber. Lyft is also the first of a number of technology IPO’s that will take place in 2019. Other technology companies that are likely to go public this year include – Uber, Airbnb, Slack, Palantir Technologies, Robinhood, Pinterest, Postmates, and WeWork.

Many on Wall Street believe 2019 will be a busy year for IPO’s, in both size and quantity. According to Statista, over the last 20 years the United States has averaged 180 IPO’s per year, with the peak coming in 1999 during the tech bubble when there were 486. The number of IPO’s over the last few years have been rather average, with the exception of a few that were quite large. Alibaba, the Chinese e-commerce company set the record in 2014 when it raised almost $22 billion.

What do these IPO’s mean for investors? The number of large, publicly traded technology companies is going to increase in the coming year and if the amount of capital invested in technology doesn’t grow in similar proportion, it could mean that the stock of other technology companies suffers as investors move investment dollars to these newly public companies. For example: an investor that already owns Apple and Amazon may want to buy Uber and Pinterest but they don’t have cash to do so. They can raise the cash needed to purchase the new names by reducing their exposure to Apple and Amazon. Oftentimes, investors don’t want to increase their exposure to the sector, so they reduce the position size in current holdings in that sector to make room for new names.

IPO’s of well-known companies such as Facebook, who IPO’d in 2012, can be a prime example of “herd mentality.” Herd mentality is a phenomenon in which people are dying to invest in something, even though they don’t understand what the company does or how it makes money. Potential investors have heard their friends and coworkers talking about the IPO and how it’s going to make them rich, so they feel a need to “get in on the action”. They want to invest because everyone else is doing it, not because they believe the stock is priced cheaply and likely to grow faster than other investors believe. Of all the IPO’s in 2019, Uber is most likely to generate the frothy investors that feel the need to invest in something they may not understand. This is by no means an implication that Uber is a bad business or investment, it is simply an example of people making decisions for the wrong reasons.