Investment Outlook: Quality Investing: A Long-Term Outperformer in a Post-Covid Economy

In the increasingly stable post-pandemic economy, the significance of quality investing is gaining recognition. This investment strategy, which prioritizes firms with robust financial health, consistent earnings, and positive cash flows, has demonstrated its capacity for long-term superior performance. The Beese Fulmer Quality Equity strategy exemplifies this approach, directing investments towards top-tier businesses that exhibit steady growth, enduring profitability, and judicious capital management.

In the context of the current market, the strategy targets large-cap US companies with highly predictable business models that support continuous revenue and earnings growth. The criteria include mature companies with intelligent capital allocation that generate higher returns for shareholders. This rigorous stock selection, combined with long-term holding horizons over 5 years and minimal portfolio turnover, captures the best investment ideas while maintaining diversification.

As the economy recovers from the Covid-19 pandemic, quality investing becomes even more critical. The economy is returning to its pre-pandemic growth trajectory, with real GDP growing 2.5% in 2023 and expectations for 1.5% to 2% in 2024. Quality companies with pricing power and effective cost control measures typically generate positive financial momentum for longer periods of time.

The stock market exhibited remarkable strength in 2023. The S&P 500 yielded a total return of around 21% for the year. The Nasdaq Composite, recognized for its emphasis on technology, experienced a surge of approximately 37%. Meanwhile, the Dow Jones Industrial Average, which consists of blue-chip stocks, increased by about 11%. These gains were primarily driven by the “Magnificent 7”. We anticipate that the markets will soon favor other high-quality companies outside of the technology sectors that will benefit from a resilient post-pandemic economy. Over time, the equity markets have demonstrated that quality investing surpasses both value and growth strategies. As the markets gradually return to their pre-pandemic norms, we believe this trend will reassert itself to other areas of the stock market.

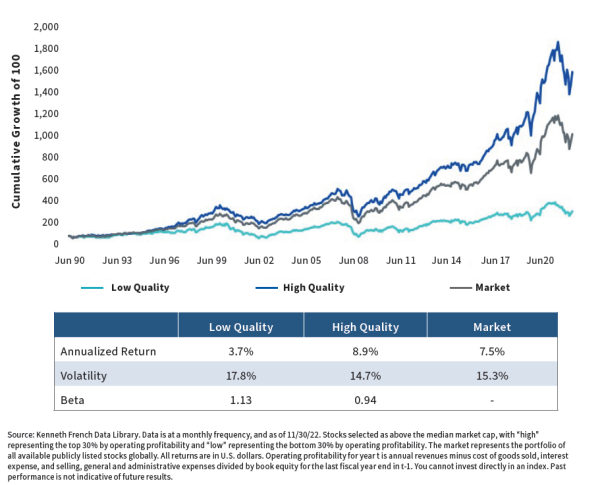

As depicted in graph below, a market study comprising the top 30% of stocks with the greatest operating profitability in the global developed equities market, has consistently outperformed the low-quality portfolio (consisting of the bottom 30% of stocks in terms of operating profitability) by over 4.5% annually since 1990. Furthermore, the high-quality approach has also surpassed the market by 1.4% per year, all the while maintaining lower volatility.