Check the Ingredients Before Biting into a Target Date Fund

It Ain’t (That) Easy

“Target-date funds” continue to gain a share of investors’ wallets, with now more than a quarter of 401k plan participants owning at least one such mutual fund. Found as an option in around 80% of employer-sponsored plans, target-date funds are mutual funds with a twist: they change investors’ asset allocations automatically as time passes.

Target-date funds are typically funds-of-funds. The target-date ‘parent’ is comprised of dozens of other funds, that themselves own hundreds of individual stocks and bonds. The parent fund over time shifts dollars into less risky assets as the ‘target date’ grows near, aiming for stability as investors approach the time where they need the funds for their life in retirement.

Does this not sound like a great product on paper? Keeping assets in a target-date fund can prevent individuals from making emotional decisions with their retirement savings, as the gradual de-risking follows a formula. Impulsively selling everything when the market is down is known to be incredibly destructive to building wealth, and yet it is a temptation that many investors succumb to. Unfortunately, while target-date funds can help somewhat with that specific behavioral bias, they do little to confront other equally problematic elements of mutual funds.

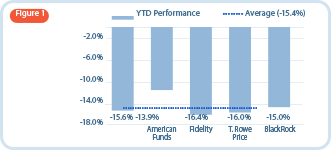

Take, for example, the YTD performance of the five largest funds with a 2025 target shown in Figure 1. They have outperformed the S&P 500 – itself down 20% over the same period – but this is little solace to someone eagerly awaiting retirement 30 months from now. 401k participants across the country are certainly reconsidering if they can retire when first planned due to the losses suffered so far this year.

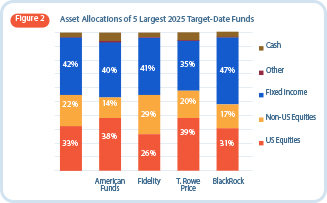

Despite the meltdown in stocks, portfolios heavy on fixed income have been experiencing even greater pain. The additional yield on a ten-year bond compared to a two-year bond has been negligible for years, and yet the leading target-date funds are more than 40% invested in bonds (see Figure 2) with average effective maturities of 7 to 8 years away. As the funds sold stocks over the last few years to meet the conservative target allocations, they used the proceeds to buy risky and overpriced bonds. Bonds have been one of the worst-performing asset classes thus far in 2022, with the index tracking U.S. corporate credit dropping 22% since the start of the year. It has been Beese Fulmer’s position for years that it is best to keep bond durations short, and it has paid off handsomely in 2022’s market.

Note that the Dow Jones Industrial Average is down 15.3% in the first half of 2022, matching the average performance of the 2025-dated funds. While the Dow is far from a perfect benchmark, every component company in the Dow will likely outperform a ten-year corporate bond purchased at a 1% yield to maturity. In fact, the Dow offers a 1.8% dividend yield currently, with potential for further return from dividend increases, share buybacks, and future capital appreciation. Furthermore, at least every company listed on the Dow Jones has the backstop of the United States’ stability and presence. Non-U.S.-based companies can be great investments, but one must take care to not take our domestic access to uniform audits and regulatory filings for granted. The extra precautions required when investing in international markets combine with greater systemic risks to make it seems imprudent to have on average 38% of the 2025 funds’ equities invested outside of the U.S. (see Figure 2)

Target-date funds demonstrably will not always have the perfect recipe for outsized returns. More importantly, such funds will never have the perfect recipe for you as an individual. For a retiree with low spending habits and years of savings, a portfolio comprised of 40% bonds may be perfectly suitable for decades of retirement income. For a retiree with fewer savings and a large family to support, an identical portfolio may be quickly depleted. While target-date funds may market themselves as a carefree way to save for retirement, I worry that their growing prevalence may grow to be harmful in the absence of accompanying due diligence. These funds are even more of a black box than most mutual funds due to their fund-of-funds structure, resulting in a median fee of 0.65% before any fees are paid to intermediaries such as brokers.

Owning individual shares of high-quality companies is still one of the best ways to weather rough times in the equity markets, just as avoiding ten-year bonds at 1% when there are two-year bonds available at 0.9% is crucial to avoiding interest rate risk. There is no level of clever asset allocation a fund can do that will replace a working understanding of your personal retirement needs and capacity to take on more risk. David Bowie said that it ain’t easy, but I’ll add that it’s worth it.