Investment Outlook: Third-Quarter 2019: What is the Yield Curve and Who Cares if it is Flat?

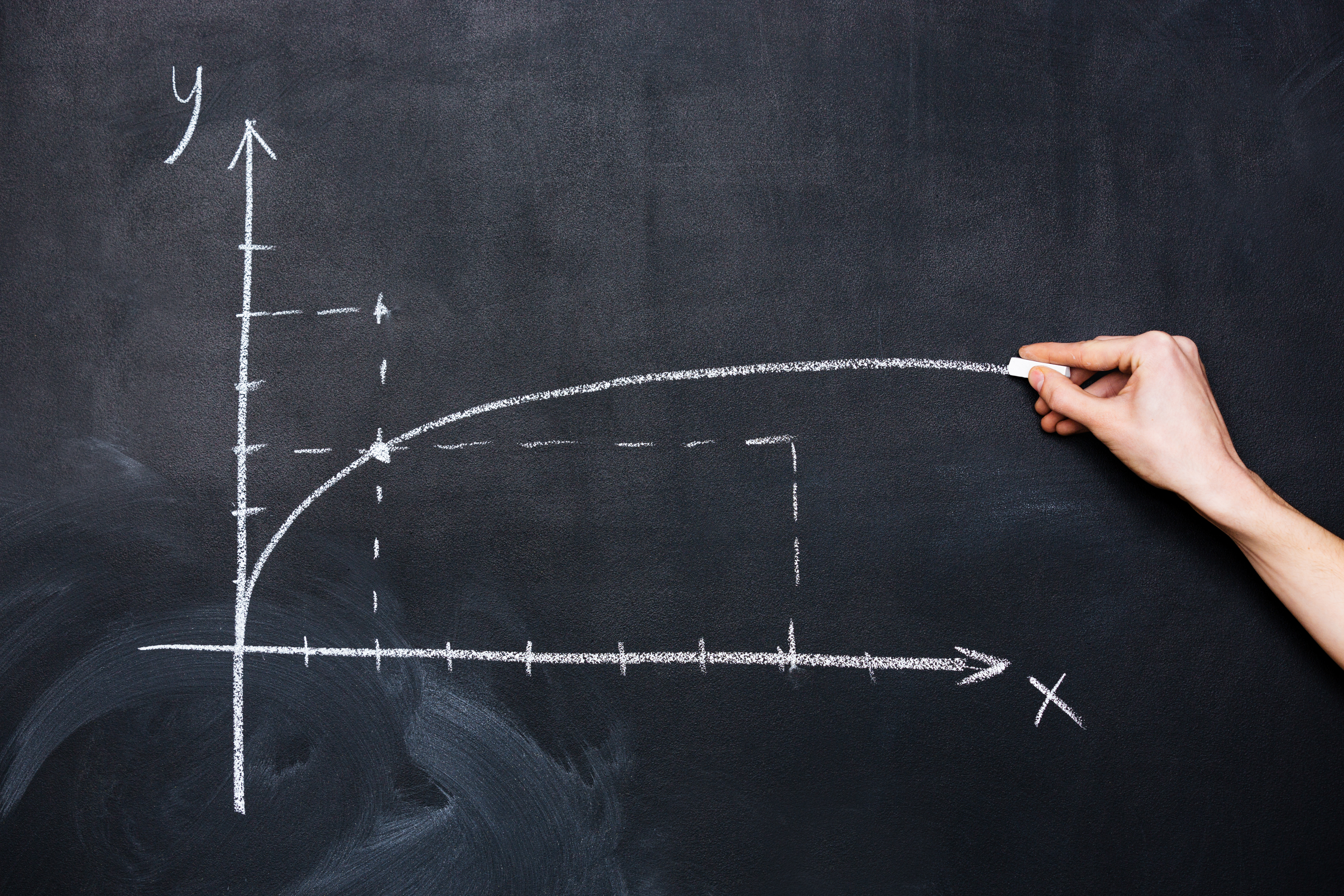

For the last year, pundits have been ruminating about the shape of the yield curve and what it means for future economic growth. Typically, longer-maturity fixed income securities pay higher yields than short-term maturities. We see this not only in a bank’s offering of certificates of deposit but also in the world’s bond markets. We now have a flat curve (isn’t that an oxymoron?) where the long-term rates are about the same as short-term rates. Decades ago, when the economy was overheating, the Fed would raise the short-term interest rates to levels equal to or higher than that of short-term rates, which caused large depositors to move their funds out of the banks into the securities markets. This would shut down mortgage lending and other new loans by the banks which in turn caused a recession. This Fed-induced flat yield curve was repeated for decades causing the strong correlation of recessions with flat yield curves.

Jumping forward to today, we have new central bank policies of zero interest rates and quantitative easing. These actions have pushed down long-term interest rates, putting the entire yield curve at a very low level. Today’s flat yield curve is the result of extremely easy money policies, whereas in the past it was due to tight money policies.

The manufacturing surveys have continued to weaken but it is still easy to get a loan today due to these easy money policies. There are other reasons for the slowdown which include the trade war with China and tensions in the Middle East. Political uncertainty at home is also causing businesses and consumers to go slower with large dollar spending, as the current administration’s pro-business policies might change after the next election.