Beese Fulmer Investment Management, Inc.

Form ADV Part 3

March 11, 2022

Introduction

Our firm, Beese, Fulmer Investment Management, Inc., is registered with the SEC as an investment adviser. Brokerage and investment advisory services and fees differ, and it is important for a retail investor to understand the differences. Free and simple tools are available to research firms and financial professionals at the SEC’s investor education website, investor.gov/CRS, which also provides educational materials about broker-dealers, investment advisers, and investing.

What investment services and advice can you provide me?

We offer investment advisory services to retail investors, including personalized confidential investment management to individuals, pension and profit-sharing plans, trusts, estates, charitable organizations and corporations on a discretionary and non-discretionary basis. We will discuss your investment goals and design with you a strategy to help you achieve your investment goals. All of our client accounts are formally reviewed by our portfolio management team on a quarterly basis. We conduct in-formal reviews of our client accounts on a weekly basis. We will contact you by either e-mail, telephone, or an in-person meeting can be scheduled to discuss your portfolio. Such monitoring is part of our standard services.

Your contract with us gives us discretionary authority when managing your account, which, while you maintain your account with us, allows us to buy and sell investments in your account without asking you in advance. We also offer accounts that give us nondiscretionary authority, meaning ones where we provide you advice and you make the ultimate decision on what investments are bought and sold.

We only offer advice with respect to exchange listed securities, securities traded over-the-counter, foreign issuers, exchange-traded funds, warrants, corporate debt securities, commercial paper, certificates of deposit, municipal securities, mutual funds, U.S. government securities, options, and interests in partnerships. Also, we typically require retail investors to open an account with a minimum investment of $500,000. We will charge investors a $5,000 minimum account fee if their account balance drops below $500,000.

For additional information, please see our Form ADV, Part 2A, specifically Items 4 and 7, for more detailed information about the services we offer.

Conversation Starters. Follow-up questions to ask your financial professional:

- Given my financial situation, should I choose an investment advisory service? Why or why not?

- How will you choose investments to recommend to me?

- What is your relevant experience, including your licenses, education, and other qualifications? What do these qualifications mean?

What fees will I pay?

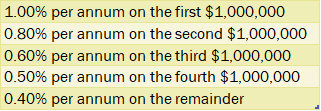

Fees and costs affect the value of your account over time. If you open an advisory account, you will pay an ongoing, asset-based fee, assessed on a quarterly basis in advance of services. Our fee schedule is below.

You will pay fees and costs whether you make or lose money on your investments over time. Please make sure you understand what fees and costs you are paying. The more assets you have in the advisory account, including cash, the more you will pay us. We, therefore, have an incentive to encourage you to increase the assets in your account. In addition to our firm’s management fee, there are other fees and costs related to our investment advisory services and investments that you will pay directly or indirectly, such as custodian fees, transactional fees, and underlying fund fees.We generally charge a minimum fee of $5,000 on all accounts with a balance of less than $500,000 in assets. Our fees are negotiable.

For additional information, please see Item 5 of our Form ADV, Part 2A.

Conversation Starter. Ask your financial professional:

- Help me understand how these fees and costs might affect my investments. If I give you $10,000 to invest, how much will go to fees and costs, and how much will be invested for me?

What are your legal obligations to me when acting as my investment adviser? How else does your firm make money and what conflicts of interest do you have?

When we act as your investment adviser, we have to act in your best interest and not put our interest ahead of yours. At the same time, the way we make money creates some conflicts with your interests. You should understand and ask us about these conflicts because they can affect the investment advice we provide you.

Here is an example to help you understand what this means. We vote proxies for the shares of stock held in our clients’ accounts. We base our decision to vote for or against certain matters based on our proxy voting guidelines. Our decision to vote for or against certain matters may conflict with a client’s wishes. We mitigate any conflict by notifying our clients when a conflict may exist and if necessary, by retaining an independent third party to the vote the proxy. We allow our clients to direct us how to vote any proxy by communicating to us their wishes in writing or electronically.

Conversation Starter. Ask your financial professional-

- How might your conflicts of interest affect me, and how will you address them?

For additional information, please see Form ADV, Part 2A and other applicable documents.

How do your financial professionals make money?

Our financial professionals’ compensation is based on multiple factors such as: assets under management, supervisory responsibilities, and the ability to attract and retain new clients. These factors do not create additional conflicts of interest other than those already described herein.

Do you or your financial professionals have legal or disciplinary history?

No.

Visit Investor.gov for a free and simple search tool to research our firm and our financial professionals.

Conversation Starter. Ask your financial professional-

- As a financial professional, do you have a disciplinary history? For what type of conduct?

Additional Information

We encourage you to seek out additional information.

For additional information on our advisory services, see our Form ADV brochure on IAPD, on investor.gov, or on our website www.beesefulmer.com and any brochure supplement our financial professional provides. To request up-to-date information or a copy of the relationship summary please call us at 330-454-6555.

Conversation Starter. Ask your financial professional:

- Who is my primary contact person? Is he or she a representative of an investment adviser? Who can I talk to if I have concerns about how this person is treating me?