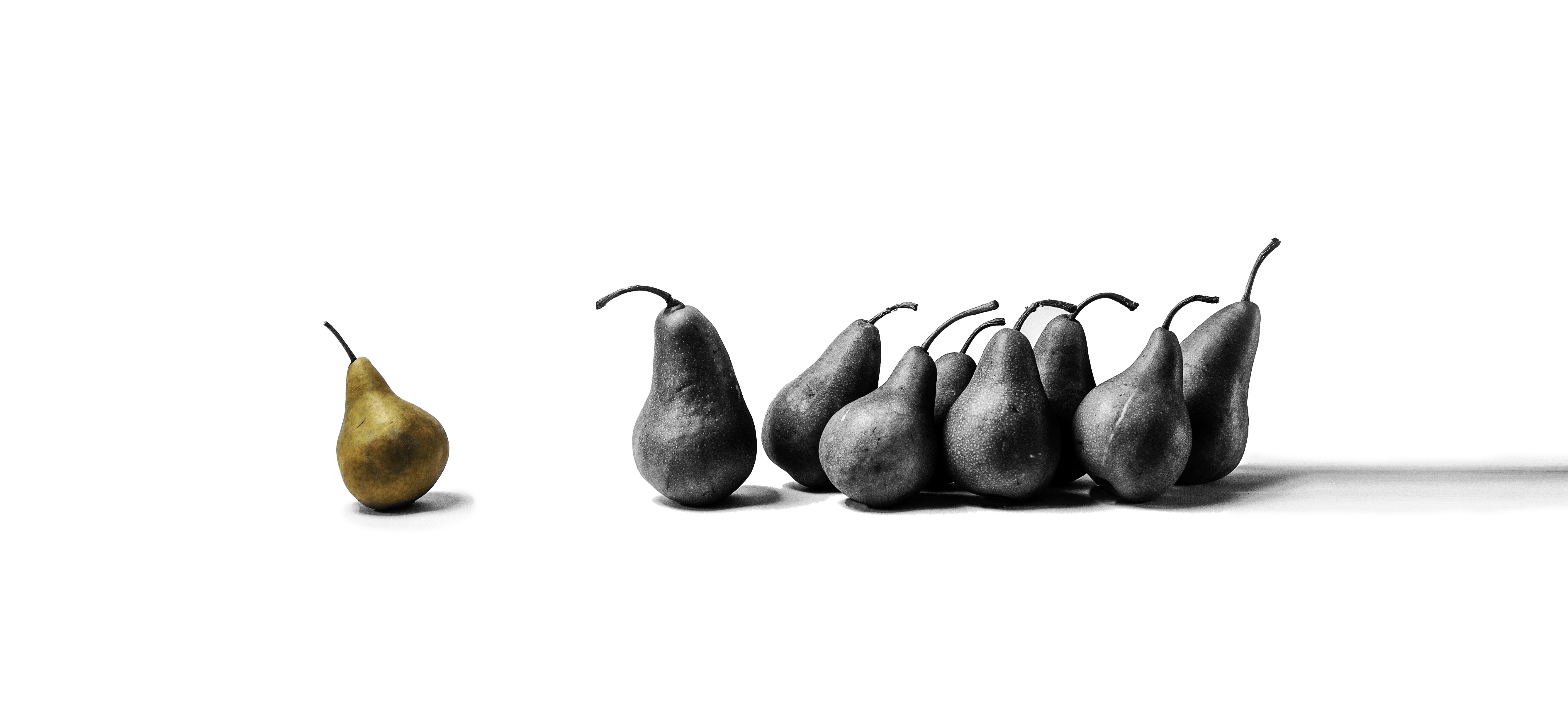

Investment Outlook: Third Quarter 2020 Herd Mentality

FOMO

Thanks to COVID-19 and the havoc it wreaked in 2020, we chose to take a hiatus from our multi-part behavioral finance series. You may remember the last behavioral article was in our Fourth Quarter 2019 Outlook. It now feels appropriate to pick up where we left off a few quarters ago.

This quarter, I thought it would be good to cover a topic we are all somewhat familiar with but perhaps need a refresher on. Herd mentality or in today’s vernacular Fear Of Missing Out (FOMO) is a mental bias we all experience in many aspects of our life.

There is safety in numbers and the brains of many mammals are programmed to think so, especially in periods of stress and risk. Zebras on the plains of Africa being a great example. While zebras live in small family groups, when they are on the move looking for fertile grasslands, they will often form much larger herds.

When it comes to physical safety, the herd makes sense; when it comes to investment ideas, following the herd can lead to sub-optimal returns. It seems obvious that investing in anything, armed with only the knowledge that others a buying it, would be a fool’s errand. However, this is where FOMO kicks in. If your neighbor is talking about making tons of money by investing in widgets, then you should be making money in widgets, too – and, the sooner you invest, the more you can make! In most instances, the best thing an investor can do is take a step back and do some homework on the potential investment. If missing the next week of potentially mind-boggling returns is the biggest concern, it likely isn’t a good investment at all.

In times of fear and uncertainty, the human brain finds safety in a herd –2020 will be reflected upon as one of the most uncertain, fear-inducing years of our lifetimes. For this reason, investors may be even more likely to follow the herd, whether it be a particular stock, cryptocurrency, or hiding money under the mattress. In the end, the investor must be aware of this bias and pushback against it. While after some research and contemplation, it may very well make sense to follow the herd – with an understanding of what is being purchased. On the other hand, after doing some homework, it might be clear that the investment is far different from the original concept. In this case, it could make sense to take the road less traveled and make the opposite investment.

In the end, be aware of the herd mentality bias and make thoughtful decisions. Don’t buy into the next big thing because everyone else is doing it.