Ask the Rational Investor: Cusp of Manufacturing Renaissance

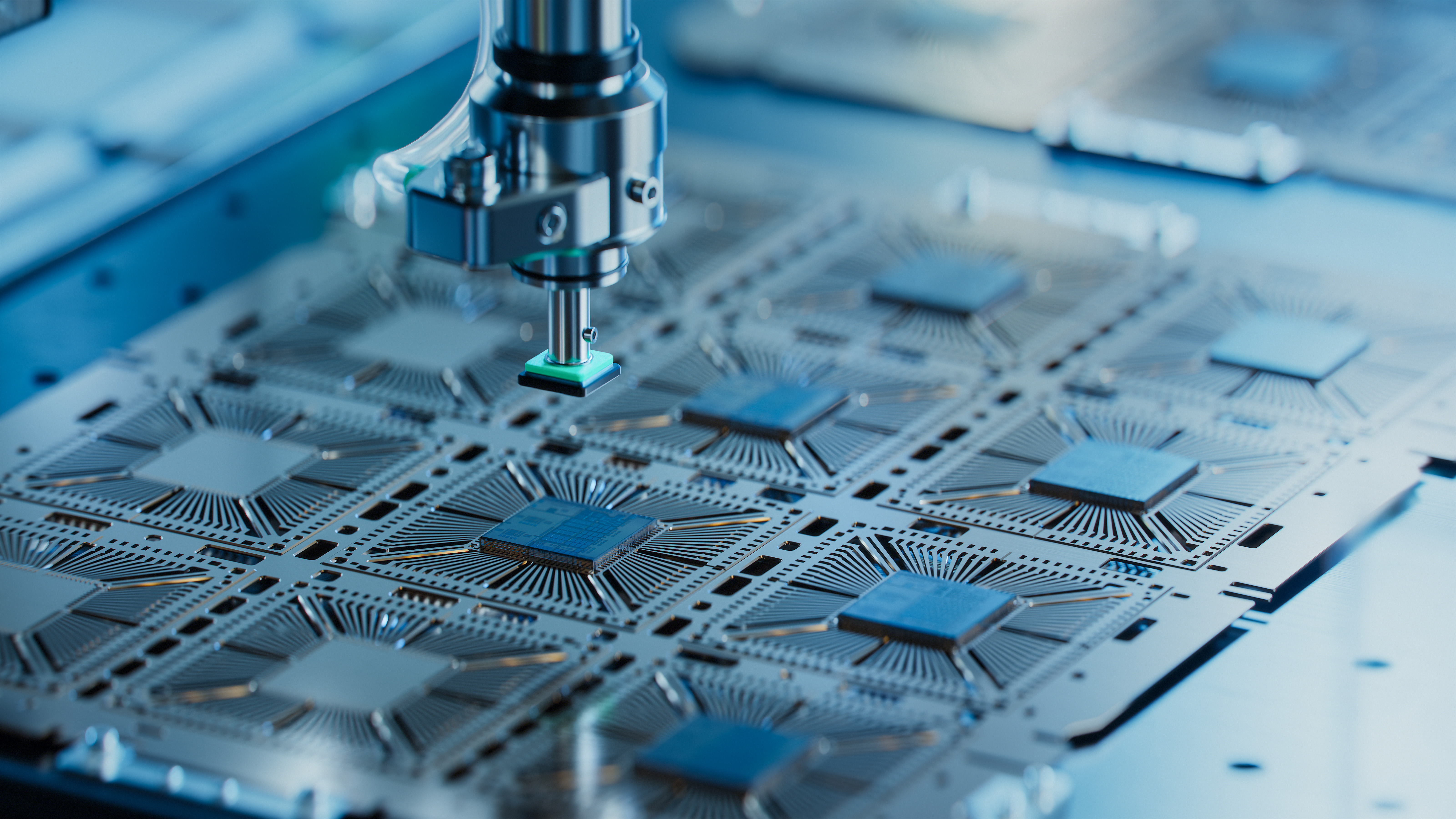

Over the next 7-10 years a dramatic increase in industrial spending is being forecasted as a result of several major infrastructure acts being passed: CHIPS and Science Act, Infrastructure and Jobs Act (IIJA), and Inflation Reduction Act (IRA).

These large infrastructure projects are related to a variety of industries such as semiconductors, biomanufacturing, batteries and electrical vehicles, heavy industry, and clean energy. Ohioans are keenly aware of some of these projects as Intel is investing $20 billion in Columbus.

Industry pundits anticipate the spending to be greater than $1 trillion. Equating to approximately 2-3 times more than the 2011-2021 industrial manufacturing index or more than $80bn per year compared around $20-30 billion per year over the last decade.

Ohio has seen the 4th largest investment in America with Texas, Arizona, and Louisiana being the only states to see more investment so far.

It’s estimated that less than $200 billion in projects have broken ground so far. These trends will be long-lasting and are just starting to impact sales and orders for companies. Many of these infrastructure projects could take anywhere from 2 to 10 years to complete.

The stocks that are beneficiaries of these trends have rallied over the last 12 to 18 months. Instead of recommending companies to purchase today, let’s look at a company to put on your watchlist and to consider buying in periods of pessimism.

One company that will benefit from the trends above is Eaton Corporation (ETN) which is based in Dublin, Ireland but has a large presence in Cleveland. Eaton sells products in the following end markets: electrical, vehicle & eMobility, and aerospace. About 90% of their profit is from the electrical and aerospace divisions which are expected to be large beneficiaries of the major infrastructure projects outlined above.

Historically, Eaton has captured about 30-40% market share in their industries. Analysts have estimated that the entire infrastructure mega trend may be a revenue opportunity for Eaton in the magnitude of $25-30 billion of which only $850 million has been awarded so far. Keep in mind that these projects are likely to last through 2030.

Increased demand and backlog of Eaton’s products is likely to boost margins and internal operating returns as customers pay more for products due to limited supply.

High quality companies often possess strong profitability, predictable growth, and shareholder-friendly capital allocation. Eaton’s management has been a strong allocator of capital to shareholders, as well as internal reinvestment and divestment of less attractive businesses.

The current valuation of Eaton is less attractive given increased visibility on revenue growth, strong management team, and enthusiasm relating to cloud projects. Patient investors are likely able to purchase Eaton at a more attractive valuation in the near future.